Manulife Investment Management

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation. We draw on more than a century of financial stewardship and the full resources of our parent company to serve individuals, institutions, and retirement plan members worldwide. Headquartered in Toronto and Boston, our leading capabilities in public and private markets are strengthened by an investment footprint that spans 19 countries and territories. Our private markets strategies include private equity and credit, real estate, infrastructure, timber, and agriculture. Responsible stewardship is integral to our business and culture, and we seek to be a global leader in creating long-term, sustainable, value for our stakeholders.

Manulife Investment Management

197 Clarendon St.

Boston, MA 02116

Amy Theuninck

Managing Director, Insurance Solutions

atheuninck@manulife.com

857-328-6425

A PRIMER ON REGULATORY CAPITAL RELIEF

Discover the evolving landscape of regulatory capital relief with insight from industry experts. Learn about the opportunities, challenges, and strategic approaches in navigating this growing market, tailored for institutional investors seeking stable income and robust diversification. Download our comprehensive primer to explore detailed strategies and analysis. Discover the evolving landscape of regulatory capital relief with insight from industry experts. Learn about the opportunities, challenges, and strategic approaches in navigating this growing market, tailored for institutional investors seeking stable income and robust diversification. Download our comprehensive primer to explore detailed strategies and analysis.

Learn MoreA Primer on Regulatory Capital Relief

Discover the evolving landscape of regulatory capital relief with insight from industry experts. Learn about the opportunities, challenges, and strategic approaches in navigating this growing market, tailored for institutional investors seeking stable income and robust diversification. Download our comprehensive primer to explore detailed strategies and analysis. Discover the evolving landscape of regulatory capital relief with insight from industry experts. Learn about the opportunities, challenges, and strategic approaches in navigating this growing market, tailored for institutional investors seeking stable income and robust diversification. Download our comprehensive primer to explore detailed strategies and analysis.

Read MoreEuropean Credit—an Income Investor's Best-kept Secret?

Global investor demand for credit has tended to prioritize the United States over Europe; however, many European credit assets have consistently delivered higher returns with lower volatility than their U.S. counterparts. We believe that there are further relative value opportunities for geographically agnostic, multi-asset credit strategies that can flexibly allocate between the two regions Discover the evolving landscape of regulatory capital relief with insight from industry experts. Learn about the opportunities, challenges, and strategic approaches in navigating this growing market, tailored for institutional investors seeking stable income and robust diversification. Download our comprehensive primer to explore detailed strategies and analysis.

Read MoreAsset Allocation Views: Diversifying in Uncertain Times

Rising geopolitical tensions and policy flip-flops have created a market landscape prone to frequent volatility. In such times, it might be important for investors to seek diversification and remain agile in search of opportunities. We look at the highlights of our latest asset allocation outlook.

Read MoreLeveraging quantitative tools for portfolio construction

Building well-balanced, diversified portfolios can help manage risk and support the pursuit of improved risk-adjusted returns over time. At Manulife Investment Management, we do this by taking a multidimensional approach to risk analysis and portfolio construction.

Read MoreDirect lending outlook: four expectations for 2024

Direct lending’s days as an esoteric asset class are no more. Offering the potential for attractive yields, reduced volatility, and portfolio diversification, this substantial segment of the private credit market seems to be becoming a core allocation for insurers, pensions, family offices, and income investors of all stripes. We believe this very moment represents an attractive entry point—and that direct lending is likely to continue shining as a critical part of a diversified portfolio in the year ahead.

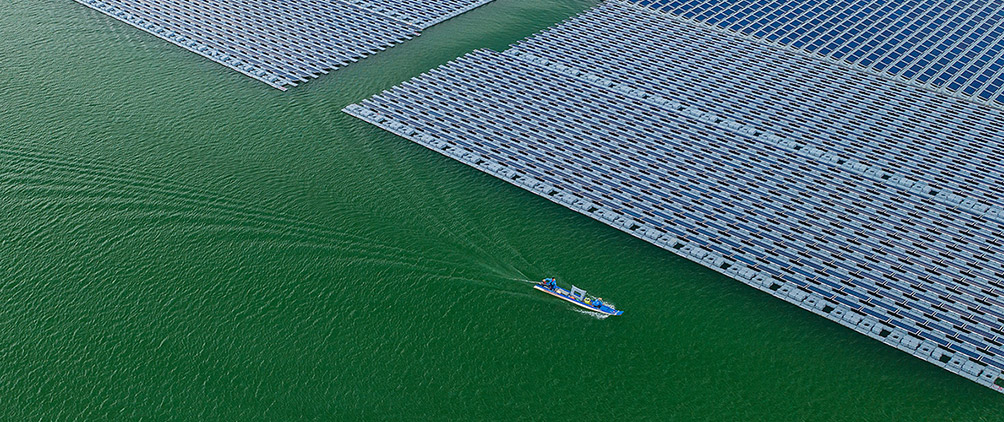

Read MoreThe opportunities and challenges of international trade in agriculture

An imbalance between limited natural resources and the growing appetite for farm products makes agricultural trade critical to meeting global food demand, bringing with it further opportunities for agricultural producers, agribusinesses, and investors.

Read MoreAn LP’s guide to a reckoning in private equity

Until 2022, the past dozen years had been kind to most private equity firms. Returns were strong and fundraising followed. Even mediocre managers were able to grow. A reckoning is coming, however, amid more challenging conditions. While some firms will adapt and flourish, others won’t. Minding two megatrends may help alert LPs to discern the difference.

Read MoreBuilding confidence: ICVCM Core Carbon Principles Assessment Framework released

The ICVCM has detailed its assessment framework, which will serve as the initial bar for determining carbon credit quality. Meaningful implications for carbon markets are likely around the corner. We share our evaluation of this quarter’s publication.

Read MoreWhy invest in agriculture now?

The solid fundamentals supporting farmland as an asset class remain. Now, new advances are sustainably increasing farmland yields while creating additional income streams.

Read MoreEnhancing farmland value through sustainable improvements

Sustainable agriculture can promote healthier and more diverse farmland ecosystems while aiming to enhance efficiency and profitability.

Read MoreMezzanine financing can shine when macro clouds loom

Yields have spiked, yet they may soon fall if the economy stalls. Investors extending junior credit, or mezzanine financing, to middle market companies now have an opportunity to lock in fixed-rate contractual coupons while they’re still high and while terms remain favorable for lenders.

Read MoreQ3 2023 Global Macro Outlook: The long and winding road

Resilience has always been viewed as a good thing. As asset allocators, it's our goal to construct portfolios that can withstand market events and do well in economic downturns. In this instance, however, resilience may not actually work in investors’ favor. The unexpected economic strength on display could—ironically—delay the path to recovery.

Read MoreData, data, everywhere: Three-minute macro

Data is our word of the month. Despite some surprising signs of economic resilience in the United States, our leading indicators still have us convinced a recession is on the way. Meanwhile, we don’t think the strong unemployment rate is a perfectly accurate description of the current (and future) labor market. Finally, the S&P 500 Index is looking strong so far this year, but we dive into how much of that performance is due to the AI craze.

Read MoreFive factors influencing the effectiveness of a 60/40 portfolio

Market commentators have devoted much energy over the past year to debating whether it’s time to write off the traditional 60/40 approach to investing that broadly allocates 60% of a portfolio to equities and 40% to fixed income.

Read MoreThe pause before the pivot: positioning bond portfolios for an evolving policy landscape

The dramatic reversal in central bank policy over the past year and a half has created plentiful opportunities in many segments of the bond market, as well as meaningfully higher yields.

Read MorePrivate equity secondaries are meeting the moment

The measure of the health of any market is whether a willing buyer can find an interested seller. That’s happening in today’s secondary market, and it’s happening at a scale that stands in contrast to other capital markets.

Read MoreBuilding confidence in the voluntary carbon market: the ICVCM's Core Carbon Principles

The publication of the Core Carbon Principles criteria for carbon programs is an important first step for strengthening confidence and should be closely followed by market participants.

Read MoreU.S. farmland investment returns: continued gains in 2022

Our optimistic outlook for U.S. agricultural investments continues following overall outstanding performance.

Read MoreDefault or not, 2011’s debt ceiling battle is instructive for today’s investors

With Congress and the White House again struggling to reach an agreement to avert a potential U.S. government debt default, investors assessing the latter stages of the spring 2023 debt ceiling conflict would do well to study how a similar battle played out in the summer of 2011, delivering a short-term blow to financial markets.

Read MoreWhat Singapore's electronics sector tells us about Asia

Singapore’s electronics industry is a vital node in the global electronics market and is particularly exposed to the changes in the global demand for electronics. Learn why the industry’s health could be seen as a proxy for the region’s economic health.

Read MoreESG ratings and data: From misalignments to global standards

Environmental, social, and governance ratings and data provided by professional services firms are fast becoming an essential part of the sustainable finance market infrastructure. But these ratings seem to shed as much light as they provoke confusion. We take a look at the current state of ESG ratings, consider some of the factors driving differences among competing rating providers, and offer a view on the future of these tools.

Read MoreThe arc of progress in global carbon markets bends toward integrity

As the world continues to adapt to climate change, carbon markets are integral to aiding the transition to net-zero emissions. Carbon markets must continue to strengthen to build stakeholder confidence and ensure that climate mitigation is delivered, highlighting the importance of establishing clear carbon standards that are systematically applied throughout development and management lifecycles to ensure quality and integrity.

Read MoreHow real assets provide real solutions: investing sustainably for a better world

Investments in real assets are valued for providing diversification benefits, inflation protection, and stable yield—they also have the potential to be part of the solution to some of our most urgent global challenges.

Read MoreReal assets: don’t let current conditions undermine your long-term success

We outline what we believe are the three main reasons why investors should consider a real assets allocation amid challenging market conditions.

Read MorePrivate equity co-investing demands micro rigor and macro perspective

Successfully executing a co-investment strategy is relatively straightforward, but in no way is it easy to accomplish. Whereas direct investing involves the full range of private equity activities—from sourcing through exit planning, from firm strategy through all elements of executing value creation strategies—co-investing involves a more limited set of requirements. Robust sourcing and effective investment selection are the ingredients for success.

Read MoreKey Trends in Real Estate Investment with IREI

Hear Erin Patterson, our global co-head of research and strategy, discuss key macroeconomic trends and long-term demand drivers influencing today’s real estate investment strategies with IREI’s Chase McWhorter.

Read MoreThe Outlook for Infrastructure as an Asset Class

In a recent asset management roundtable, our Global Head of Corporate Finance and Infrastructure John C.S. Anderson discussed the benefits of a well-diversified infrastructure portfolio that can deliver exciting opportunity alongside demonstrated protection against volatile economic cycles.

Read MoreInsurers are creatively investing in a growing asset class: natural capital

Insurers facing increasing regulatory and public pressure to manage climate-related risks are seeking to allocate their invested assets in ways that can support sustainability, the energy transition, and even nature itself through natural capital.

Read MoreEpisode 268: The Power of Patient Capital: Navigating Private Credit Through Market Cycles

Join host Stewart Foley, CFA on the InsuranceAUM.com Podcast as we explore direct lending, sponsored finance, and middle market private equity, with insights into private credit opportunities for insurance investors.

Read MoreEpisode 264: The Future of Real Estate: Trends and Strategies with Maggie Coleman

Join host Stewart Foley on the InsuranceAUM.com Podcast as he discusses real estate investing trends, challenges, and opportunities.

Read MoreEpisode 244: Risk, Opportunity, and Flexibility in Today's Credit Market: Jason Walker of Manulife CQS

Jason Walker is the Co-Chief Investment Officer at Manulife CQS.

Read MoreEpisode 195: Infrastructure Equity with Manulife’s John Anderson

John Anderson is the Global Head of Corporate Finance and Infrastructure at Manulife Investment Management and John Hancock Life Insurance.

Read MoreEpisode 185: Unlocking Forest Carbon Opportunities with Eric Cooperstrom

Eric Cooperstrom is the Managing Director of Impact Investing in Natural Climate Solutions at Manulife Investment Management.

Read MoreEpisode 149: Capturing Alpha in the Secondary Market through GP-Led Transactions

Paul Sanabria and Jeff Hammer are Senior Managing Directors and Global Co-Heads of Secondaries at Manulife Investment Management.

Read More